|

Attending a fintech conference can be a valuable opportunity for professionals in the financial technology industry to learn about the latest trends, network with their peers, and discover new business opportunities. However, with so many sessions and events packed into a single conference, it can be tough to make the most of your time and resources. Here are the top 10 ways to maximize the value of attending a fintech conference.

Bonus Tip! Join us at the U.S. Fintech Symposium to take advantage of expert insights and network with industry leaders, all while staying up-to-date on the latest financial technology innovations.

0 Comments

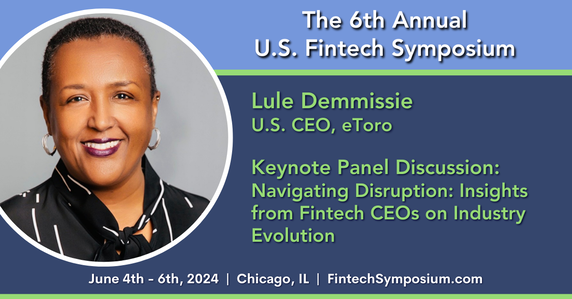

We’re thrilled to announce two new exciting speakers joining the 6th Annual U.S. Fintech Symposium, bringing their unique insights and experience. Click on their images to learn more about them and their sessions.

In today's rapidly evolving financial landscape, the integration of fintech into treasury management is not just an opportunity; it's a necessity. The emergence of fintech has provided treasury professionals with powerful tools to enhance efficiency, improve risk management, and drive strategic value. This white paper aims to highlight the transformative potential of fintech in treasury operations, offering insights into real-world applications and practical strategies for leveraging these technologies. The Evolution of Treasury Management Traditionally, treasury management has focused on core activities such as cash management, risk mitigation, and ensuring liquidity. However, the advent of fintech is reshaping these functions by introducing automation, real-time data analytics, and enhanced security measures. These advancements enable treasurers to move beyond traditional roles, positioning them as strategic advisors within their organizations. Key Areas of Transformation Automation and Efficiency The primary advantage of fintech solutions lies in their ability to automate routine and repetitive tasks within treasury management. Key areas where automation proves beneficial include:

Real-Time Data and Analytics The integration of fintech into treasury operations brings a wealth of real-time data and advanced analytics capabilities:

Enhanced Risk Management Fintech solutions offer sophisticated tools for assessing and managing financial risks:

Improved Cash Management Advanced cash management solutions provided by fintech platforms offer significant improvements in liquidity management:

Cybersecurity and Fraud Prevention Fintech innovations are pivotal in enhancing the security of financial transactions:

Practical Strategies for Leveraging Fintech Strategic Partnerships for Banks & Technology Providers Forming strategic partnerships with fintech companies can bring several advantages:

Integration with Existing Systems Seamless integration of fintech solutions with existing treasury systems is crucial:

Continuous Fintech Training Ongoing training and development are essential for keeping treasury teams proficient with the latest fintech advancements:

Data-Driven Decision Making Leveraging the analytics capabilities of fintech for informed decision-making can significantly enhance strategic outcomes:

Regulatory Compliance Staying abreast of regulatory changes and ensuring fintech solutions comply with all relevant regulations is critical:

Conclusion The digital transformation of treasury through fintech is a game-changer, offering unparalleled opportunities for efficiency, risk management, and strategic value creation. By embracing these technologies, treasury professionals can not only enhance their traditional roles but also drive their organizations toward greater financial agility and resilience. We've just added several great speakers who bring their talents and expertise to the 6th Annual U.S. Fintech Symposium Click on their Images to learn more about them and their sessions.

We're thrilled to announce Inspirit as a Startup Sponsor for the U. S. Fintech Symposium on June 4-6, 2024 in Chicago, Illinois. Inspirit is a leading IT outsourcing and tech consulting company dedicated to delivering cutting-edge software solutions to startups and SMBs. They understand that every business is unique so they specialize in building and scaling software applications that perfectly align with their clients' objectives. Services include: Custom Software and Product Development, UI/UX Product Design, Strategic Business Analysis, Software modernization, Security, and Expert IT Consulting and Support. To learn more visit www.inspiritdev.com.  We're delighted to announce that Riaz Syed, Founder and CEO of Infinant, will be speaking at the U.S. Fintech Symposium! With over 30 years of experience in global fintech and entrepreneurship, Riaz is a seasoned leader in the industry. Prior to founding Infinant, he managed technology teams within global fintech and successfully founded Zenmonics, a fintech that provided a technology platform for banks. After leading Zenmonics to become an industry leader, Riaz founded Infinant, a Charlotte-based fintech offering a SaaS platform enabling banks to power their embedded finance programs and compete against BaaS providers. Riaz's panel, "Collaboration for Impact: How Banks, Regulators, and Tech Innovators Can Drive Responsible Growth Together," promises invaluable insights into fostering collaboration for responsible growth in fintech. Join us to hear from Riaz and other industry experts at the U.S. Fintech Symposium!  We’re excited to announce that Jesse Honigberg, Executive Vice President of Products and Platforms at Customers Bank will be speaking at The U.S. Fintech Symposium as a panelist on "Next-Gen Payments: Emerging Technologies & Strategies." With over 25 years of experience in financial services and technology, Jesse is passionate about driving transformative change and fostering strategic partnerships. Throughout his career, he’s led large-scale transformations and reorganizations, managed multi-country teams, and spearheaded the digitization of client experiences. Jesse's leadership roles have included driving large-scale transformations, managing multi-country teams, and spearheading the digitization of client experiences. His strategic acumen has been pivotal in negotiating contracts, managing significant budgets, and steering complex product implementations in marketplace lending, instant payments, API gateways, and direct deposit platforms. A recognized leader in the industry, Jesse is a regular speaker at significant events, sharing insights on digitization, payment modernization, and the challenges and opportunities within the sector. His innovative approach to leveraging cutting-edge technologies and fostering strategic partnerships has positioned his organizations at the forefront of the financial technology evolution.  We're excited to announce Sarah Grotta, Deputy Chief Fintech Officer at FinWise Bank, as a keynote panelist at the upcoming U.S. Fintech Symposium! With over 25 years of executive leadership in traditional banking, embedded banking, payments, and fintech, Sarah brings a wealth of expertise to the table. Since joining FinWise Bank in 2023, Sarah has been instrumental in expanding the bank’s fintech offering to include cards and payments. Her background encompasses product innovation, development, and launch, along with strategic and business planning. Sarah is a well-known figure in the industry, regularly participating as a speaker, writer, and subject matter expert, focusing on payment cards, ACH, real-time payments, and emerging banking and payments technologies. Join us for her panel discussion, "How Innovative Card, Payment & Technology Solutions are Shaping Fintech Banking," and gain insights into the future of fintech banking from one of the industry's top experts!  We're excited to announce the addition of Kandie Alter, Assistant Vice President of the Federal Reserve Bank of Chicago’s Payments Policy Group, to our lineup of panelists at the U.S. Fintech Symposium! Join us for her panel discussion, "Next-Gen Payments: Emerging Technologies & Strategies," where Kandie will share her invaluable insights into the evolution of payment systems. In her role, Kandie conducts research and market monitoring on retail payment systems, focusing on digital innovation, modernization, and the evolution of domestic and cross-border payments. Her leadership was instrumental in leading the drafting team for the 2017 Faster Payments Task Force final report, which laid the groundwork for instant payments in the United States.  We're thrilled to announce another outstanding keynote panelist joining us at the U.S. Fintech Symposium: Lule Demmissie, US CEO of eToro! Lule brings a powerhouse of experience, leading eToro's charge in revolutionizing trading and investing platforms. Her insights will be invaluable on our panel, "Navigating Disruption: Insights from Fintech CEOs on Industry Evolution." As the US CEO of eToro, Lule oversees the company's expansion and investment within the US, operational infrastructure, marketing, investment thought leadership, and regulatory affairs & risk management. As the former President of Ally Invest and with key roles at TD Ameritrade, Lule has spearheaded groundbreaking initiatives in fintech and retail investing. Her leadership is reshaping the landscape of financial services.  We're thrilled to announce a new addition to our lineup of keynote panelists at the U.S. Fintech Symposium: Aaron Bright, Head of B2B Business Development at Galileo Financial Technologies! Aaron will be speaking on our panel, "How Innovative Card, Payment & Technology Solutions are Shaping Fintech Banking," bringing invaluable insights to the conversation. With a proven track record in strategic business development, Aaron has played a pivotal role in Galileo's growth, crafting innovative go-to-market strategies that have reshaped the fintech landscape. His expertise in navigating complex negotiations and fostering strategic partnerships will shed light on the latest trends and opportunities in fintech banking.  We are delighted to announce another esteemed panelist for the upcoming U.S. Fintech Symposium: Victor Wang, CEO of Stockpile. Victor brings over 25 years of entrepreneurial experience to our panel, along with a profound passion for removing barriers in the financial industry and empowering individuals to take control of their financial futures. As CEO of Stockpile, Victor has been at the helm of a revolution in investing, empowering the next generation of investors through hands-on learning and accessible platforms. Under Victor's guidance, Stockpile has garnered widespread acclaim for its innovative approach, making stock market participation engaging, collaborative, and accessible.  We are thrilled to unveil our latest keynote panelist for the upcoming U.S. Fintech Symposium: Phil Goldfeder, CEO of the American Fintech Council! As CEO of the American Fintech Council, Phil has been instrumental in shaping the future of fintech innovation, making him a perfect fit for our discussion on the evolving landscape of financial technology. Phil brings a wealth of expertise and leadership from the forefront of the fintech revolution, making his insights invaluable to our symposium. Attendees can expect engaging sessions where they can not only learn from industry leaders like Phil Goldfeder but also actively participate in discussions that drive innovation and progress in the fintech landscape.  We're extremely pleased to announce Devtron as a Silver Sponsor for the U. S. Fintech Symposium on June 4-6, 2024 in Chicago, Illinois. Their dedication to innovation and excellence complements our mission of providing attendees with an unparalleled experience. With their partnership, we're positioned to create the most memorable and impactful event of the year. Devtron is an innovative tool specifically designed for companies looking to harness the power of Kubernetes, boosting developer productivity and streamlining operations. Devtron offers two main use cases: firstly, it dramatically accelerates the adoption of Kubernetes, enabling rapid scaling and optimization of application development cycles. Secondly, Devtron aids in the seamless distribution of software across diverse deployment environments, including hybrid-cloud, on-premises, and air-gapped systems. This dual capability makes Devtron an essential solution for organizations aiming to modernize their infrastructure and deliver robust applications efficiently and securely. Visit devtron.ai to learn more.  We are delighted to introduce Steve Bishop, the Chief Innovations and Operations Officer at Old Missouri Bank, who will be a Moderator for the Peer-to-Peer Discussion titled "The Rise of Embedded Finance: Exploring the Next Frontier of Financial Services Partnerships" during the 6th Annual U.S. Fintech Symposium, scheduled for June 4-6, 2014. Steve Bishop joined OMB Bank in 2020 and oversees its physical and digital operations including its rapidly growing Banking as a Service division. Preceding OMB, Bishop had two separate stints at Jack Henry & Associates, most recently as Director of Client Services. Between roles at JHA, he worked for AT&T as a Senior Financial Analyst in its Financial Leadership Development Program and for Citibank as Vice President of Offshore Management. Bishop holds master’s degrees in Operations, Finance and Strategy as well as Information Management from Washington University - St. Louis and a bachelor's degree in Economics & Finance from Missouri Southern State University.  We're thrilled to announce that Robert Fernandes from The Investment Center, Inc. will be joining us as an esteemed speaker at our Peer-to-Peer Discussion titled "Navigating Cybersecurity Challenges in Fintech Partnerships" during The U.S. Fintech Symposium Meeting set for June 4-6, 2024. As the Chief Information Security Officer (CISO) of The Investment Center, Inc., Robert has over 21 years of experience in Information Technology and Cybersecurity within the financial services industry. He leads a team of IT and security professionals who are responsible for ensuring the security, compliance, and resilience of the company's IT infrastructure, systems, and data. He also oversees the development and implementation of Cybersecurity policies, procedures, standards, and best practices that align with the company's strategic goals and regulatory requirements.  We're extremely pleased to announce Finwise Bank as a Silver Sponsor for the U. S. Fintech Symposium on June 4-6, 2024 in Chicago, Illinois. Their commitment to innovation and excellence perfectly aligns with our mission to deliver an unparalleled experience to our attendees. With their partnership, we're poised to make this year's event the most memorable and impactful yet. FinWise Bank is a state-chartered bank headquartered in Murray, Utah and helps facilitate innovative, secure and financially wise card, payment, deposit and lending solutions for leading Fintechs, businesses and consumers. For more information on FinWise Bank, visit www.finwise.bank.  The U.S. Fintech Symposium has been recognized as one of the top fintech events to attend in 2024 by Finextra. This prestigious recognition further solidifies our position as a leading event for fintech industry professionals seeking valuable insights, networking opportunities, and strategic discussions. Finextra states, "If you appreciate the charm of the Midwest, the US Fintech Symposium in Chicago is an event you won't want to miss. This symposium brings together the finest minds in the fintech industry and offers deep dives into regulatory changes, market trends, and strategic insights. With Chicago's rich financial history as a backdrop, attendees can expect a wide array of topics covering everything from blockchain to insurtech. Whether you're an entrepreneur, investor, or executive, the US Fintech Symposium provides an environment conducive to collaboration and knowledge exchange." Register now for the U.S. Fintech Symposium to reserve your place and ensure you're part of the conversation shaping the future of finance.  We're thrilled to announce that Daniel Thomason from Google will be a distinguished panelist at our Keynote Panel, "Next-Gen Payments: Emerging Technologies & Strategies," during The U.S. Fintech Symposium Meeting on June 4-6, 2024. With his extensive expertise, Daniel will offer invaluable insights into the future of payments and emerging technologies. Daniel has been a product manager since 2016 and has been in his current role at Google since 2022, where he leads product for Google Wallet Payments. Originally from Australia, Daniel has worked in four countries on three continents in a variety of roles, from central bank economist, to escape room founder, to product manager. Daniel currently lives in San Francisco with his wife and family, and in his free time he can be found cooking, doing yoga, and playing board games.  TreaSolution is thrilled to welcome Infinant as a Platinum Sponsor for the U. S. Fintech Symposium on June 4-6, 2024 in Chicago, Illinois! Their partnership promises to enhance the experience for all attendees. Infinant, a Charlotte, N.C.-based technology provider, offers a virtual banking platform that acts as the growth engine for banks to expand their digital distribution channels to grow deposits and fee income. The cloud-native SaaS platform enables numerous business models on a single platform, including Direct Banking-as-a-Service, Embedded Finance and Digital Brands. The Interlace platform is unique in providing the bank complete control of customers, accounts and transaction processing for operational compliance and regulatory alignment. Our bank clients are able to launch alternative growth channels and expand beyond their geographic footprints to advance their banks. To learn more about your future, visit www.infinant.com.  We're delighted to announce that John Major, Vice President for The American Deposit Management Company, will be joining us as a distinguished speaker at The U.S. Fintech Symposium, happening from June 4-6, 2024! John will be moderating the highly anticipated Peer-to-Peer Discussion titled "Building Strong Fintech-Financial Institution Partnerships." John’s 10 years of investment and financial services experience includes Financial Advisor positions with national wealth management firms before joining ADM in 2017. He has partnered with dozens of financial institutions and FinTechs on strategy for deposits totaling more than $4 billion.  TreaSolution is very excited to to announce that American Deposit Management has joined us as a Silver Sponsor for the U. S. Fintech Symposium on June 4-6, 2024 in Chicago, Illinois!! Their support adds immense value to this premier event in the heart of the fintech industry. The American Deposit Management Co. [ADM] is your Modern Cash Solution. Since 2009, ADM has been a premier partner across many sectors, including the ever-evolving FinTech space. With customized solutions and an experienced team you can trust, allow us to help elevate your Financial Institution. Visit americandeposits.com to learn more.  We are thrilled to announce that Steve Kenneally from American Bankers Association will be joining us as a distinguished speaker at The U.S. Fintech Symposium, set to take place from June 4-6, 2024! Steve will be taking part as a panelist in the highly anticipated Keynote Panel Discussion titled "Next-Gen Payments: Emerging Technologies & Strategies." Steve Kenneally works at ABA on a range of payment systems including check, ACH, card, wires, as well as coins and paper money. He spends an increasing amount of time focused on emerging payment technologies such as mobile payments, virtual currencies, and blockchain technology, with an eye towards making them faster, safer, and frictionless in the future. He is the staff liaison to two standing member committees focused on payments issues in addition to ABA’s Emerging Payments Advisory Group. He served as Chair of the International Banking Federation Payments Working Group and he is an elected member of the board of the Faster Payments Council and serves on Nacha’s Payments Innovation Alliance Consumer Payments Advisory Committee. Prior to joining the ABA in 2005, he served at the United States Department of the Treasury where he managed the private network of banks collecting non-tax payments on behalf of the federal government and drafted regulations and guidance on cash management issues.  We are thrilled to welcome Rick Galasieski, General Manager from Super.com as a moderator for the Peer-to-Peer Discussion "The Evolution of Banking APIs: Opportunities and Challenges for Partnerships" at the 6th Annual U.S. Fintech Symposium. Mr. Galasieski is the General Manager at Super.com, a growth stage company that has raised $200M+ since inception. Super.com is a platform built to help the low income, subprime demographic, save money, earn money, and manage money while building their credit with innovative products like the Super Secured Mastercard. With a legacy in fintech, he was the VP of Strategic Partnerships and Business Development for Green Dot's BaaS platform, driving collaborations with the likes of Intuit, Shopify, Stripe, and Uber. Previously, as the VP of Strategic Development and Emerging Payments for EPS Financial, he played a pivotal role in the growth and ultimately in its acquisition by Pathward, formerly MetaBank. He was responsible for a robust payments module embedded in industry leading tax preparation software, processing billions of dollars. He was a pioneer in the early days of GPR consumer prepaid cards, overseeing marketing and program management as the COO of BankFreedom.  We're thrilled to share an exciting announcement! Join us in welcoming Attila Csutak, the Electronic Payments Team Lead at City National Bank, as he brings his expertise and insights to the Keynote Panel Discussion titled "Next-Gen Payments: Emerging Technologies & Strategies" at the 6th Annual U.S. Fintech Symposium in Chicago on June 4-6, 2024. Attila Csutak’s career spans 26 years in Treasury Management practice with Large Financial Institutions (top 5 domestic and international) and a large Fintech company. Attila held product development, product strategy roles and currently manages a team of product managers. His knowledge of all payment types and systems provided the background required for kick starting the RTP, Zelle (ClearXchange) and FedNow efforts. Participated as a subject matter expert in two major acquisitions Fiserv executed to address the growing needs of Faster Payments needs of Financial Institutions in the U.S.A. Currently Attila Csutak is the Payables Team Lead (Legacy and Faster Payments) with City National Bank, where he serves as the internal and external evangelist for Emerging Payments (Real-time Payments) and provides leadership of day-to-day responsibilities of rolling out and managing the new payment rail. Attila is a Certified Product Manager (PMC) and received a Bachelor of Science in Computer Science and Application Programming. |